Last blog post, we talked about common questions homeowners and homebuyers have about appraisals. This time, I want to talk briefly about the approaches to value.

There are 3 approaches to value: the income approach, the cost approach and the sales comparison approach.

The income approach is commonly used when valuing rental properties. As a certified residential real estate appraiser, I’ve only used this approach to value a handful of times. Often, property owners need to know what to expect from a purchasing an income generating property and this approach to value, also called the income capitalization approach to value, can help an investor determine cash flow and reversion. A gross rent multiplier (GRM) is calculated in this process.

The cost approach is used mainly for new construction, although some banks and lending institutions ask for it regularly. It’s an approach to value that considers site value, quality and condition, effective age of a property, size, and depreciation to determine the value of a home based on information often gleaned from national cost estimating software, local builder costs, and other local economic considerations without the soft costs like builder’s profits. I may generate a value using the cost approach, but rarely do I give it any weight.

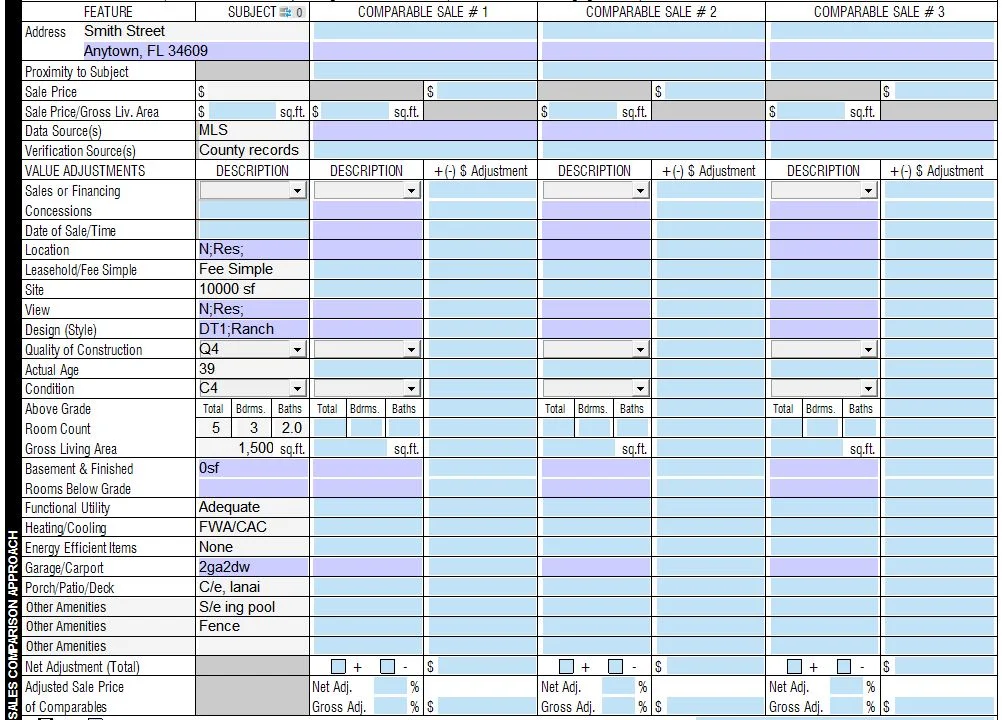

Which brings us to the 3rd and most utilized approach to value - the sales comparison approach. This is what I’m using 99.99% of the time to determine what I think (an appraiser’s opinion) the value of a home is on the day that I “observe” it (rather than say “inspect” it as “inspection” gives the connotation that I’m doing some sort of home inspection which I’m not). I’m going to compare your home to others like it that have sold in the area (much like the cost approach) also considering site value, quality and condition, effective age of a property, size and amenities, and I’ll adjust them up and down, up when the comparable sale (comp) is inferior to the subject, and down when the comp is superior. This should, if I’ve used the best available sales, give me a reasonable idea of what the home is worth on that day.

compare - make dollar adjustments

like it - this is very subjective, but typically means same age, same size, similar bedroom/bathroom count, garage size, lot size, pool or not

area - a determined (by the individual appraiser) market area consisting of similar properties that would compete for a local buyer’s interest.

Next time, we’ll look at suggested guidelines and how they affect the appraisal.