As an appraiser, I’m asked the same questions over and over. And it’s OK, I’m glad people ask questions. Sometimes I think loan officers are telling people in their office, “When he gets there, just sit there quietly and don’t ask any questions.”

Used to be, no one understood what an appraiser did, and people didn’t really trust us. Heck, the banks were the ones sending us out to your house to tell you what it was worth. And when the housing market took a dump, we were blamed, at least partially, as the problem. Not that appraisers or the industry as a whole didn’t have something to do with it, but we were the ones who were really trying to be the voice of reason in all of the chaos. I remember running around our old office saying, “Did they find gold out here or something? Is an automobile manufacturer moving in, or a Six Flags…” because virtually overnight, values were doubling.

But the general public, homeowners, are much more savvy now. Banks, mortgage companies and loan officers seem to know more about what they’re doing and what we do than in the past, and quite frankly, we’ve all gone through the housing crisis once already… We’re not going to go through it again, we’re too smart now, too educated, right?

So, when I get to someone’s house to do an appraisal inspection, walk-through or appraisal observation as FHA (HUD) would like us to call it, I always ask them at the end, “Do YOU have any questions for me?” Ultimately, here’s what people ask me, and here are my typical answers (of course the answers can vary depending on the individual assignment).

1. When will we know something? Typically, my due dates are scheduled 24 to 48 hours after the inspection. When I’m finished, I send the appraisal to an appraisal management company (AMC) who, after they go over it, send to the bank or lender. Sometimes they ship it that day… I can’t tell you how long they’ll keep it. They may ask for minor revisions. Then it goes to the company who ordered the appraisal. Once they sift through it with a fine toothed comb, they alert all parties to the sale, and then you’ll know how it turned out.

2. Can you have a copy of the appraisal? People hate this answer, but technically, the appraisal is the property of the company who ordered it, EVEN THOUGH IT’S YOUR HOUSE! So, don’t get upset, just ask for a copy, and they’ll most likely give you one.

3. Can I tell you what it’s worth at the inspection? Nope. I can never talk value with a homeowner, or seller, or buyer, or realtor. It’s confidential information, even though it’s your house. The company who orders the appraisal and owns it gets the distinction of telling you what it’s worth. Usually, by the time I show up to your house, I’ve researched your property in the county records, and local Multiple listing service (MLS) if it’s been posted for sale. I may even look up old MLS sheets so I have a better idea what the interior may look like or looked like at last purchase. But I don’t know what it’s worth anyway, not that early in the process. I have to verify that everything I’ve researched is true. County records can be wrong, and MLS sheets can be wrong. People do stuff to their homes all of the time, so the county doesn’t know the condition of your home, it could be remodeled for all they know.

4. Does messiness matter? People are often worried that since their garage is messy, or their kids bedrooms haven’t been picked up, that it may affect their appraisal. Now don’t get me wrong, messiness can be distracting, but messy and condition are two different animals. I can see past the laundry and boxes, and I can tell if a home has been maintained or not. Believe me, most everyone has messy closets and garages.

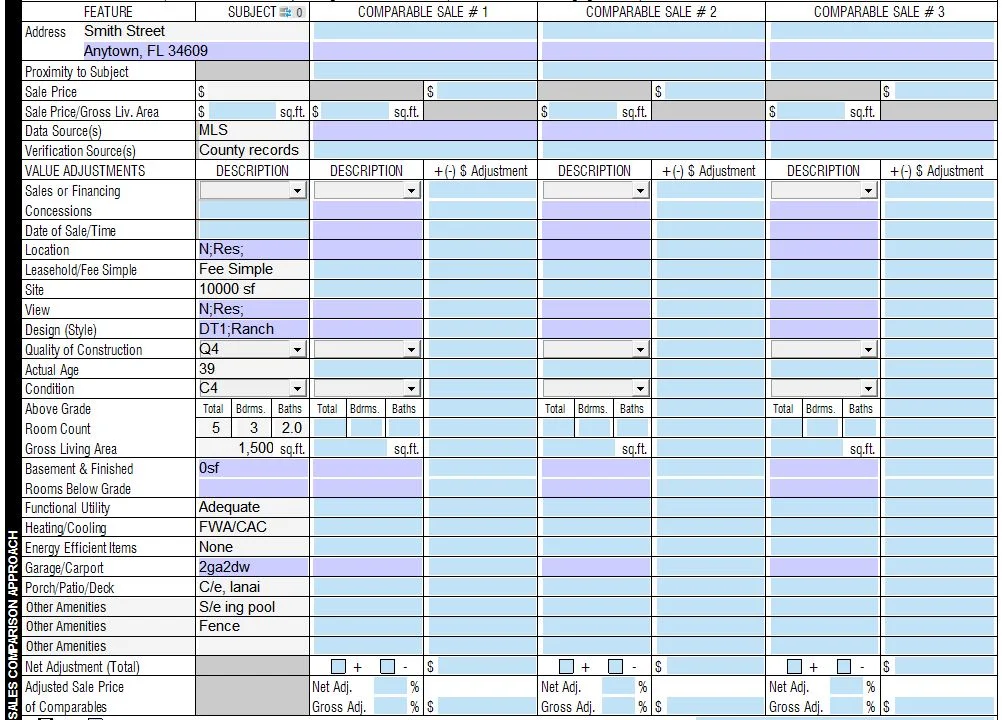

5. Do I care about your Zestimate or county assessment? Please understand, I don’t hate Zillow and I use county records as verification sources every day. But what Zillow does can be a dis-service to you. They show a Zestimate, and it’s not always based on what an appraisal is based on (we’ll talk about the sales comparison approach in the next blog post). They have a proprietary algorithm they use and won’t divulge, whereas appraisers use standard appraisal practice and experience to determine values. And your county assessment is based on a mass appraisal done once a year… I’ve seen both Zillow and county information be high, and I’ve seen them both be low.

If you have any questions about real estate appraisals, leave a comment, text us, give us a call or send an email. If I don’t know the answer, I’ll get it for you. And if you don’t need an appraisal, I’ll try to talk you out of it.